Credit card info for dating sites

In the realm of digital romance, where hearts quest for meaningful connections, there exists a crucial aspect that often goes unnoticed – the method of financial verification on relationship websites. This section delves into the significance of safe and discreet payment alternatives that empower individuals to explore these platforms with minimal risk to their financial privacy.

As we embark on this journey through the virtual landscape of love, it becomes paramount to address the elephant in the room – the handling of financial credentials in a sector where trust and reputation are paramount. By adopting a thoughtful and informed approach, one can enjoy the benefits of modern matchmaking without compromising personal financial data.

The digital age has revolutionized the way people meet and form relationships, and with it comes a multitude of platforms designed to help individuals find their perfect match. However, before these platforms can unlock their full potential, a prerequisite is often completing a financial verification process. This section will navigate the myriad of options available for this very purpose, ensuring that users can focus more on the pursuit of love and less on the safety of their financial information.

Safeguarding Your Financial Data on Personal Connection Platforms

In this digital era, where online platforms facilitate personal connections, the need for ensuring the security of financial data has become paramount. This section will highlight effective strategies to fortify your account and protect your sensitive information while engaging with these platforms.

Understanding the Risks

Before diving into the strategies, it's crucial to comprehend the potential threats to your personal finance data. Misuse of financial data on these platforms can lead to unauthorized transactions, identity theft, and other fraudulent activities. Awareness of these risks is the first step towards safeguarding your data.

Implementing Best Practices

Use Strong and Unique Passwords: Create strong, unique passwords that are not used on other platforms. Consider using a password manager to generate and store complex passwords securely.

Enable Two-Factor Authentication (2FA): 2FA provides an additional layer of security. Even if someone gets your password, they won't be able to access your account without the second form of verification, usually a code sent to your phone.

Monitor Your Statements: Regularly check your financial statements for any suspicious activity. If you notice anything unusual, report it immediately to your bank or financial institution.

Be Cautious with Sharing: Never share your financial data directly on these platforms. If a request for your data seems suspicious, it's best to verify the legitimacy of the request with customer service.

Utilize Virtual Credit Card Numbers: Some financial institutions offer services to generate virtual credit card numbers that can be used for online purchases. This adds a layer of security as these numbers are typically used for a single transaction and cannot be used again.

Use Reputable Dating Sites: Stick to well-known and respected platforms for personal connections. They are more likely to have robust security measures in place to protect your data.

By implementing these practices, you can significantly reduce the risks associated with using personal connection platforms. Remember, it's not just about protecting your financial data but also about maintaining your overall security and privacy online.

Understanding the Risks of Sharing Card Details

In our increasingly interconnected world, sharing sensitive financial information has become almost second nature. However, this ease of exchange comes with potential consequences. This section delves into the critical aspects of the dangers associated with disclosing payment card information on various platforms.

The Digital Threat Landscape

Online platforms, such as virtual meeting spaces, are fertile ground for unscrupulous individuals. The sharing of payment card details can lead to a host of problems, ranging from identity theft to financial loss. It is essential to understand the various methods fraudsters employ to extract sensitive information and the steps one can take to protect oneself.

One of the most significant concerns is the potential for electronic payment theft. This encompasses a wide range of activities, including but not limited to phishing, which involves the use of deceptive tactics to trick users into sharing their financial details. Additionally, there is a risk of unauthorized access, where cybercriminals exploit vulnerabilities in a system to obtain sensitive information without consent.

Consequences of Compromised Information

The fallout from a breach of financial information can be far-reaching. Beyond the immediate loss of funds, individuals may face long-term issues with their creditworthiness and personal reputation. It is not uncommon for victims to spend months or even years recovering from the damage caused by a single act of fraud.

Moreover, the subsequent damage to one's financial profile can have a ripple effect on personal and professional life. It is crucial to weigh the risks and rewards of sharing payment card details before proceeding with any transaction, especially on less secure platforms.

In conclusion, it is imperative to exercise caution when handling and sharing sensitive financial information. By understanding the threats posed by these pitfalls, individuals can take proactive steps to safeguard their financial health and maintain their privacy in the digital age.

Best Practices to Safeguard Your Personal Payment Data

In today's digital age, where transactions often happen at the click of a button, it's crucial to ensure that your financial information remains secure. Whether you're shopping online, subscribing to services, or using your payment details for verification, here are some practical tips to maintain the integrity of your personal payment data.

Use Secure Passwords and Two-Factor Authentication

Start by creating strong, unique passwords for your accounts and change them regularly to minimize the risk of unauthorized access. Additionally, enable two-factor authentication wherever possible; this provides an extra layer of security, as it requires not only a password but also a second verification step, such as a code sent to your mobile device.

Be Wary of Phishing Attempts

Beware of suspicious emails or messages asking for your payment information. Legitimate companies will never ask you to provide sensitive data via email. If in doubt, contact the company directly through their official channels to verify any request for information.

Keep Your Software Updated

Regularly update your operating systems and antivirus software to protect against the latest security threats. Software updates often include patches for security vulnerabilities that could be exploited by cybercriminals.

Shop on Secure Websites

When making online purchases or providing payment information, ensure the website has 'https' in the URL and a padlock icon in the address bar. This indicates that your information is being transmitted securely over an encrypted connection.

Use Credit Monitoring Services

Consider subscribing to a credit monitoring service that can alert you to any unusual activity on your accounts. This can help you quickly detect and respond to any unauthorized use of your payment details.

Review Your Statements Regularly

Regularly check your financial statements for any unfamiliar transactions. If you notice anything suspicious, report it immediately to your bank or financial institution.

Limit Stored Payment Information

Avoid storing your payment information on websites unless you trust their security measures and need to make frequent purchases. The less widely your data is stored, the lower the risk of it falling into the wrong hands.

Conclusion

By following these best practices, you can significantly reduce the chances of unauthorized access to your personal payment data. Stay informed about the latest security developments and remain vigilant in protecting your financial well-being in the digital space.

Choosing Secure Dating Platforms

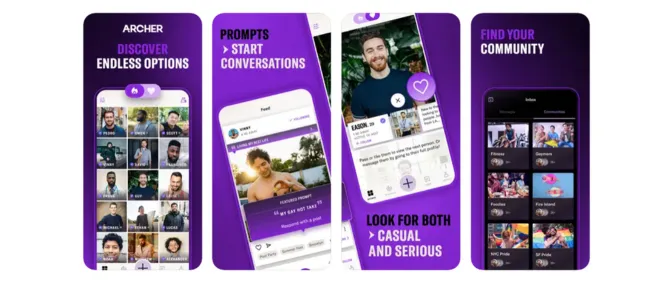

In the digital realm of romance, where connections are forged with just a few clicks, the need to select a trustworthy platform that respects privacy and offers a secure environment cannot be overstated. It's not just about finding a match; it's about finding one in a safe space where your personal details are protected, and your experience is nothing but pleasant. This section will guide you through the essential aspects to consider when choosing a dating platform that champions security and reliability.

Evaluating the Platform's Reputation

Before you entrust your personal information to any online dating platform, it's crucial to research its reputation. Look for reviews from other users, both positive and negative, to get a well-rounded perspective. Pay attention to any mentions of security breaches or instances of privacy neglect. Platforms that are widely regarded as safe have likely implemented robust security measures to defend against unauthorized access and data leaks.

Security Features and Protocols

A reliable dating platform will advertise its security features prominently. Look for platforms that employ encryption to safeguard your information during transmission. SSL certificates are a common sign of a platform's commitment to secure transactions. Additionally, two-factor authentication can provide an extra layer of protection for your account. Don't hesitate to reach out to customer support to inquire about the specific security protocols they have in place.

Privacy Policies and Data Handling

Understanding how your data is collected, stored, and used is imperative when selecting a dating platform. A trustworthy platform will have a transparent privacy policy that clearly outlines these practices. It should detail what information is required, how it's protected, and whether it's shared with third parties. Be wary of platforms that are vague or lack a comprehensive privacy policy.

User Verification Processes

One of the hallmarks of a secure dating platform is its commitment to user verification. This process helps to ensure that the profiles you interact with are legitimate and reduces the likelihood of encountering malicious users or scams. Platforms that go the extra mile to verify users often require documentation or social media links, adding a level of confidence to the online dating experience.

Reporting and Blocking Mechanisms

No platform is immune to the occasional bad actor. Therefore, it's essential to choose a platform that provides easy-to-use reporting and blocking features. These tools empower users to swiftly address any concerning behavior or suspicious activity, with the ability to report profiles to the platform administrators or block them outright for peace of mind.

By carefully considering these factors, you can navigate the online dating landscape with confidence, focusing on the pursuit of meaningful connections rather than the worry of compromised security. Remember, the right platform will prioritize your peace of mind as much as your potential for romance.

Recognizing Signs of Potential Fraud

In the vast and sometimes uncertain digital landscape, it is crucial to be vigilant about the integrity of the personal information we share. Awareness of potential fraudulent activities is the first line of defense in maintaining the security of our financial identities. With the rise of online interactions, the need to spot and respond to warning signs of scams and deceit has become paramount. This section aims to provide insights into identifying red flags that may indicate nefarious intentions, safeguarding your privacy and well-being.

Indicators of Suspicious Behavior

One key aspect of recognizing potential fraud is understanding the behavior patterns of those who may be attempting to exploit personal data. Watch for the following signs:

Unsolicited requests for sensitive information: Be wary of anyone pushing for immediate access to secure details like account numbers, passwords, or personal identification.

High-pressure tactics: Scammers often create a sense of urgency to prompt unwise decisions. Avoid sharing any information if you feel pressured or rushed.

Misspellings and poor grammar: Fraudulent messages or profiles may contain errors in language usage, which can be a sign of less-than-legitimate correspondence.

Online Red Flags

In the digital environment, there are certain indicators that should raise suspicion:

Request for money or gifts: Alarms should sound if someone you've never met asks for financial assistance, regardless of the reason.

Secrecy or avoidance: Genuine individuals are usually open about their lives and circumstances. Persistent secrecy should be a cause for concern.

Unrealistic claims: Trust your instincts if someone's profile or story seems too good to be true; often, it is.

Transactional Concerns

Regarding financial transactions, keep an eye out for:

Unrecognized charges: Regularly review your statements for any unrecognized or unauthorized payments.

Multiple attempts on accounts: A series of failed log-in attempts could indicate an attempt to hack into your accounts.

Changes in account information: Contact your service provider if you notice any unapproved changes to account details.

By staying alert to these warning signs and taking proactive measures to protect your personal information, you can significantly reduce the risk of becoming a victim of fraud in the digital realm.

Reporting and Seeking Assistance After Data Breach

In the unfortunate event of a security breach, swift action is vital to mitigate potential damages and protect one's privacy. Initiating a report and seeking assistance should be the immediate course of action after a breach occurs. This involves notifying the relevant parties and understanding the steps required to secure personal information. Here, we discuss how to engage these crucial processes to recover and safeguard compromised data effectively.

Initial Steps After Suspecting a Breach

When the possibility of a data breach arises, the first step is to identify the extent of the intrusion. Review recent transactions and account activity to determine if unauthorized access to your private information has occurred. It is crucial to remember the importance of notifying the authorities promptly and changing your passwords to prevent further misuse of your information by malicious actors.

Contacting the relevant authorities: Notify your financial institution and credit monitoring agencies of the breach as soon as you are aware of the issue. This can help you take additional precautions and monitor your accounts for further fraudulent activity. Be sure to keep a record of all your correspondence and any steps taken.

Seeking Help from Third-Party Agencies

In addition to reporting the cyber attack to the appropriate authorities, seeking assistance from third-party resources can provide further support in resolving your data breach issues. Experienced professionals in the field of cybersecurity can help investigate the incident, guide you on potential legal action, and offer advice on how to prevent future attacks. It is essential to research and choose a reputable service before sharing any sensitive information.

Reputation and reliability: Prioritize third-party agencies with a solid history of successful cases and satisfied clients in similar situations. Doing so will increase the chances of receiving effective support and ultimately pave the way for healing your online presence after a breach.

To summarize, taking immediate action after a data breach is crucial in mitigating damages and protecting your sensitive information. Reporting the breach to pertinent authorities and seeking assistance from recognized third-party agencies will help guide you through the process of regaining control of your digital identity and maintaining online privacy. Be vigilant and mindful of your steps, and engage in preventive measures to reduce the risk of future occurrences.

The Future of Online Dating Security

As the world increasingly embraces digital connections, the realm of online matchmaking continues to evolve at a rapid pace. In this brave new world, the safety and privacy of individuals are paramount, especially when it harbors sensitive personal data. This section will delve into the emerging technologies and practices that are set to transform the landscape of online romance, ensuring protection is at the forefront of every swipe right.

Innovative Authentication Methods

The era of usernames and passwords is slowly waning. Biometric security measures such as facial recognition, fingerprint scanning, and voice recognition are becoming the new standard. These methods offer an extra layer of security, enabling platforms to verify the identity of users more efficiently, thus mitigating the risk of impersonation and fraud.

Enhanced Data Protection Regimes

As global conversations around data privacy reach a crescendo, lawmakers are enacting more stringent regulations concerning the storage and handling of personal information. In the future, we can expect that dating platforms will need to comply with ever-evolving legal requirements to protect the sensitive details of their clientele.

While these tools offer promising solutions, their integration must be approached with caution. The balance between providing a secure environment and respecting user privacy will continue to be a key focus as we look to the horizon of online dating security.